The EU’s Omnibus has rolled up: three flagship regulations delayed or watered down. With Trump’s assault on climate and DE&I, it’s time to ask: are the wheels falling off sustainable growth? Sustainable business was once the engine of green growth. Today’s EU proposal weakens rules on reporting, taxonomies and due diligence – labelling them “red… Continue reading Are the wheels falling off Sustainable Growth?

Author: richardhardyment

Richard Hardyment is a Director at Corporate Citizenship, a global management consultancy. He has spent over a decade advising companies on responsible business practices and sustainability. He was previously a political advisor and Senior Strategic Advisor at Forum for the Future.

The First CSR Sustainability Report (1649)

When did CSR reporting start? When was sustainability reporting first introduced? The historical origins of the world’s first ever corporate sustainability & CSR report can be traced to 1649.

Participatory Measurement

Where are the people in sustainability & ESG data? Who decides what good business looks like? The legitimacy of sustainability measurement is rarely questioned. In the top-down, standardised frameworks of ESG World, it’s the standard setter, ranker or rater in Amsterdam, London or New York who decides. But sustainability impacts are bottom up: complex, dispersed,… Continue reading Participatory Measurement

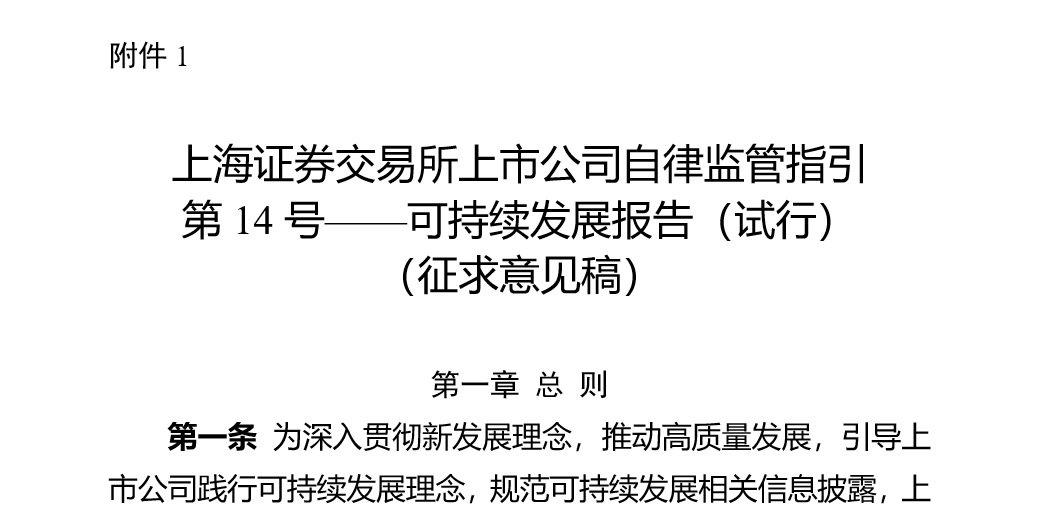

China goes for double materiality

China is going for double materiality – launching new sustainability standards with Chinese characteristics. The big revelation from new reporting guidance recently launched is the impact focus. Listed companies in Shanghai, Shenzhen and Beijing will need to disclose not just those topics that affect financial value, but any which “have a significant impact on the… Continue reading China goes for double materiality

Ethical Materiality

Ethical materiality – going beyond financial and double materiality to consider morals and ethics in prioritising responsible and sustainable business issues

Can we measure greenwashing?

Greenwashing is back and regulators are waking up to the challenges. But what do we mean by ‘greenwashing’ and can regulators and raters really measure it? Greenwashing has shot up the agenda this week. The UK’s Competition and Markets Authority has announced a new investigation into Unilever’s environmental claims. The CMA will explore whether brands… Continue reading Can we measure greenwashing?

IFRS Knowledge Hub vs GRI’s Sustainability Innovation Lab

IFRS Knowledge Hub vs GRI Sustainability Innovation Lab – what’s the difference?

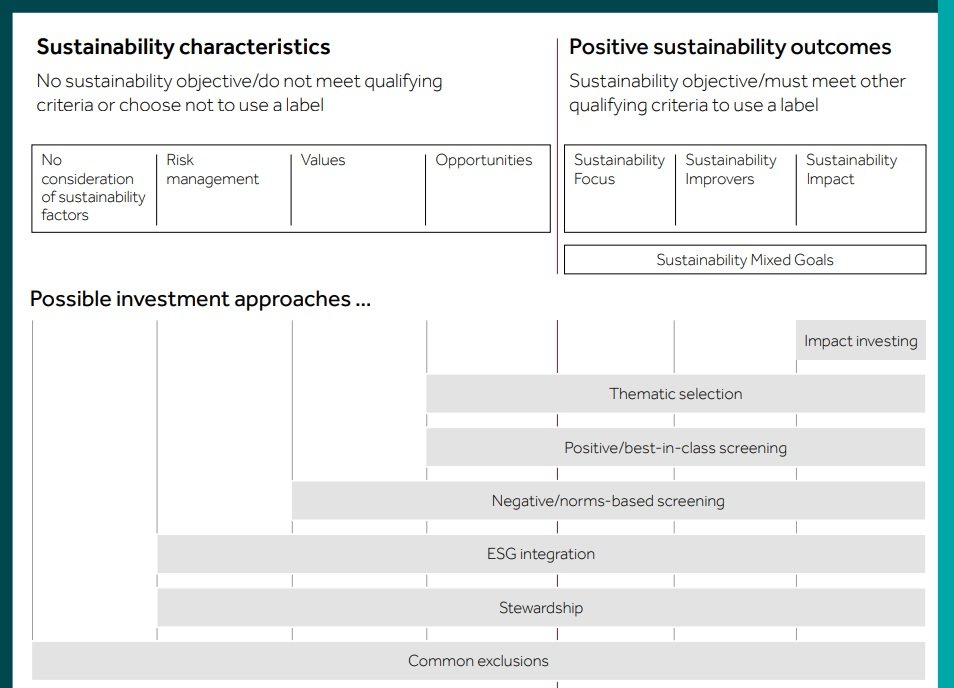

FCA’s New Fund Labelling: Will it stop the greenwashing?

Curious news emerged recently on ESG fund labelling. With COP28 kicking off, the UK’s Financial Conduct Authority confirmed plans to press ahead with an ambitious new labelling regime to reduce greenwashing. Then Reuters reported that the EU has put it’s own plans on hold – citing “compliance fatigue”. What’s going on? There’s no doubt that… Continue reading FCA’s New Fund Labelling: Will it stop the greenwashing?

“Sustainable Investing” is shrinking

Sustainable investing is shrinking, according to a major new study. Market turmoil, the backlash against ESG and new regulations mean that fewer assets are being described as “sustainable”. But this is all good news. Why? Because with a history of woolly definitions, fluffy frameworks and some outrageous greenwashing, it’s actually a great sign that the… Continue reading “Sustainable Investing” is shrinking

EU Reporting: Mandatory or Voluntary?

It always did seem a tall order. That great big long list of mandatory disclosures facing European businesses has just got a lot shorter. In fact, companies can now opt out of disclosing on large number of the new sustainability metrics. It’s all thanks to something called materiality. It makes me wonder, how much of… Continue reading EU Reporting: Mandatory or Voluntary?